Baker Hughes and Frontier Carbon Solutions have formed a strategic partnership to advance large-scale carbon capture and storage (CCS) and power solutions in Wyoming. The partners are expanding its energy infrastructure with 256 MW of gas-fired generation to meet growing power demands, with Baker Hughes' NovaLT™ gas turbines supporting this development.

Baker Hughes will assist with technologies for well design, CO2 compression, and long-term monitoring to enhance efficiency and financial certainty to support hashtag CCS, power generation, and datacenter projects.

Frontier is developing the Sweetwater Carbon Storage Hub (SCS Hub) in Wyoming, one of the largest carbon sequestration assets in the country. The hub aims to serve industrial emitters and ethanol facilities across the U.S by rail transportation.

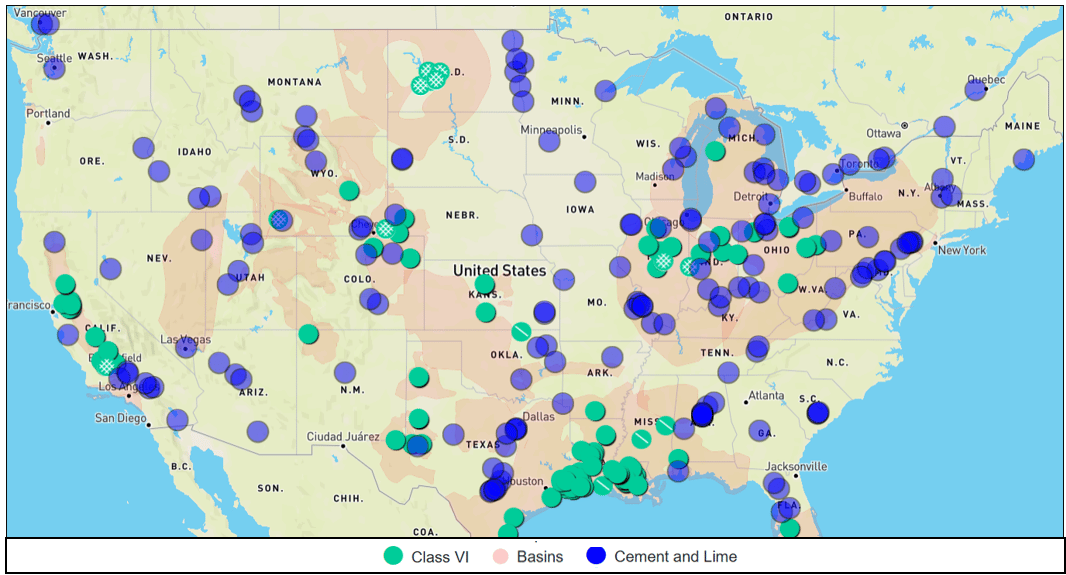

Wyoming issued the Class VI permit for the Sweetwater Hub in December 2023. The 100,000 acre project plans to inject around 1.2 million tons of CO2 per year with 3 injection wells.

Tenaska submitted a Class VI application for the Tri-State Buckeye 1 asset in Carroll County, Ohio. The Buckeye 1 asset is the first to be permitted. Tenaska plans to develop an additional 6 wells in Jefferson County and 3 wells in Harrison County for the sequestration hub.

Orlen and Equinor signed an MoU to develop carbon capture and storage projects. The partnership will explore storage sites in Poland, including onshore areas and the Baltic Sea. Orlen aims to capture, transport, and store 4 million metric tons of CO₂ annually by 2035. Equinor is the leader in Carbon Storage with their flagship Snovhit, Sleipner, and soon to be operational Northern Lights project.

Malaysia is introducing CCS bills to support low carbon development throughout the country. The bills are expected to be finalized later this year. The region is seeing rapid growth is CCS projects including Thailand, Singapore, and Indonesia - all vying for Major E&P’s development and capital. Players like ExxonMobil, Shell, ADNOC, and TotalEnergies are exploring for sequestration sites offshore Malaysia.

Bison Low Carbon Ventures, operator of the Meadowbrook CO2 Storage Hub in Sturgeon County, Alberta, received ‘D065’ scheme approval from the Alberta Energy Regulator.

The Project is set to begin commercial operations by the end of 2025 and is likely the first under Alberta’s open-access carbon sequestration hub program to reach this milestone.

Supported by investors Marubeni Corporation and Mizuho, Bison plans to expand the project in phases, starting with small-scale operations (<100ktpa) and eventually increasing to over 3Mtpa as CO2 storage demand grows.

The project will provide a reliable CO2 sequestration solution for industrial emitters in the Edmonton region, leveraging the favorable Woodbend Group storage reservoir.

California Resources Corporation’s Carbon TerraVault, have signed a MOU with National Cement Company of California to provide carbon management services for the "Lebec Net Zero" project. This initiative aims to capture up to 1 million metric tons of CO₂ emissions for CTV’s sequestration assets.

It is set to become California’s first net-zero cement facility, integrating carbon capture technology and utilizing locally sourced biomass fuel for producing limestone calcined clay cement (LC3).

The project is one of 33 selected by the U.S. Department of Energy for funding, with the DOE committing up to $500 million in matching funds. Operations are expected to begin in 2031, pending approvals.

Our Take: The decarbonization of the cement industry is challenging due to high capture costs and little to no premium for low carbon cement. In addition, cement facilities are located near limestone quarries to simplify logistics. These limestone quarries are distant from carbon sequestration assets with further complicates CCS for the industry. This project is located nearby advantaged sequestration to enable full value chain CCS. Carbon capture is required to decarbonize the industry, the future is uncertain on whether sequestration or utilization (creating value products) will be the preferred path forward.

Twelve raises an additional $83 million in their Series C round for further project funding. The company is producing e-SAF in their Moses Lake, Washington Facility through proprietary technology. The funding will further support technology scale up and project development for expansion.

StormFisher Hydrogen partners with MAN Energy Solutions for their Texas synthetic fuels project. The 200 MW facility is expected to generate 2.5 million MMBtu of e-NG annually, equivalent to approximately 50,000 metric tons of liquefied natural gas (LNG).

Share this newsletter to friends and colleagues!

Tell us how we can improve: [email protected]